Customs Documents – Everything You Need to Know

1. What Are Customs Documents?

Customs Documents are a collection of necessary paperwork required for customs clearance when importing or exporting goods. They are an essential part of the international shipping process, enabling customs authorities to monitor shipments, apply taxes, and ensure compliance with legal regulations.

2. Why Are Customs Documents Important?

Customs documents play a crucial role in:

- Ensuring legal customs clearance: These documents verify the origin and legality of goods.

- Calculating customs duties and taxes: They help customs authorities apply the correct tax rates for different goods.

- Preventing trade fraud: They help combat smuggling and tax evasion.

- Protecting business interests: Proper documentation reduces risks of penalties or cargo being held at ports.

3. Essential Types of Customs Documents

Here are the most common and important customs documents for import and export:

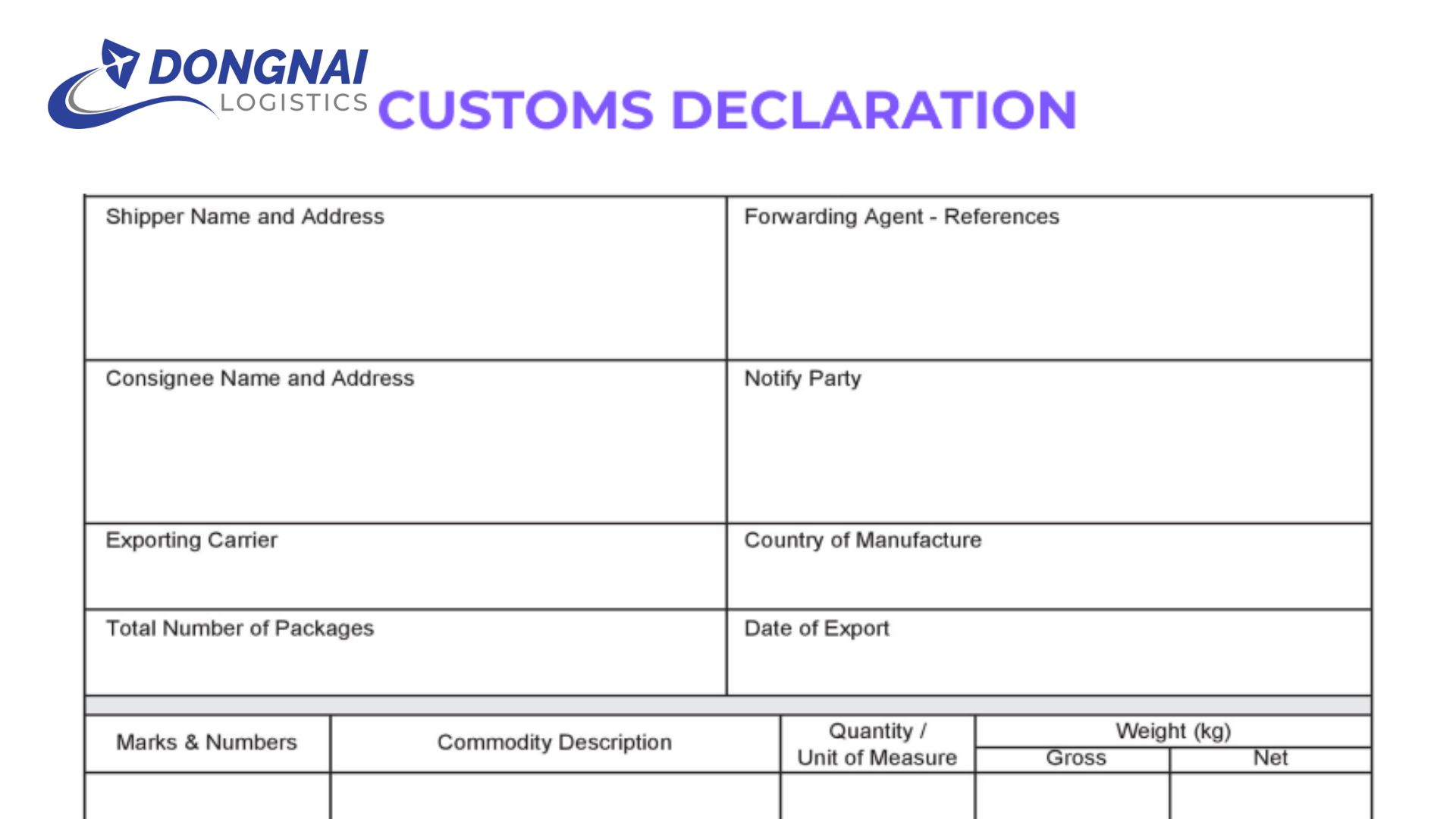

3.1. Customs Declaration Form

- The most critical document in customs clearance.

- Submitted by businesses or customs brokers to customs authorities.

- Includes details about goods, HS codes, quantity, value, origin, sender, and recipient.

3.2. Commercial Invoice

- Records the transaction value between the buyer and seller.

- Used to calculate import duties and VAT.

- Must contain complete details about goods, unit prices, delivery terms (Incoterms), and payment methods.

3.3. Packing List

- Provides details on the quantity, weight, and packaging of goods.

- Helps customs and recipients verify shipments accurately.

- Assists in handling claims in case of delivery discrepancies.

3.4. Bill of Lading (B/L) or Airway Bill (AWB)

- Issued by the carrier to confirm goods have been shipped.

- Serves as a receipt, transport contract, and proof of ownership.

- For sea freight: Bill of Lading (B/L) is used.

- For air freight: Airway Bill (AWB) is used.

3.5. Certificate of Origin (C/O)

- Certifies the country of origin of goods.

- Allows businesses to benefit from tariff preferences under trade agreements.

- Issued by an authorized organization in the exporting country.

3.6. Phytosanitary/Health Certificate

- Mandatory for food, agricultural, animal, and plant products.

- Issued by quarantine authorities to ensure food safety compliance.

3.7. Certificate of Inspection

- Confirms goods meet technical and quality standards of the importing country.

- Required for products such as machinery, equipment, and high-tech goods.

3.8. Other Required Documents

Depending on the type of goods and the country’s regulations, additional documents may be required:

- Import/Export License

- International Sales Contract

- Cargo Insurance Certificate

4. Customs Document Processing Procedure

4.1. Document Preparation

Businesses must prepare all required documents before the goods arrive at the port or airport.

4.2. Customs Declaration

- Companies or brokers declare shipment details via the electronic customs system.

- Submit necessary documents for customs review.

4.3. Inspection and Clearance

Customs authorities categorize shipments into different inspection channels:

- Green Channel: No inspection; goods are cleared immediately.

- Yellow Channel: Document verification required.

- Red Channel: Both document and physical cargo inspections required.

Once inspections are complete, the goods are allowed for import/export.

5. Key Considerations When Preparing Customs Documents

- Ensure accuracy and consistency with actual goods.

- Comply with specialized inspection regulations (if applicable).

- Store documents for at least five years for post-clearance audits.

- Stay updated on the latest customs regulations to avoid errors.

6. Conclusion

Customs documents determine whether goods can be legally imported or exported. Proper preparation, accuracy, and compliance with procedures help businesses save time, reduce costs, and mitigate risks. Always stay informed about the latest regulations to ensure a smooth customs clearance process!

Read more:

The Bill of Lading (B/L): 5 Things You Need to Know About

Thủ tục nhập khẩu, xuất khẩu hàng hóa tại Việt Nam

Vận chuyển hàng hóa từ Đồng Nai đi Phú Quốc

Chuyển phát nhanh từ Quảng Ninh đến Đồng Nai chất lượng, uy tín, giá cạnh tranh